WHAT’S THE COST-BENEFIT ANALYSIS OF MORALITY?

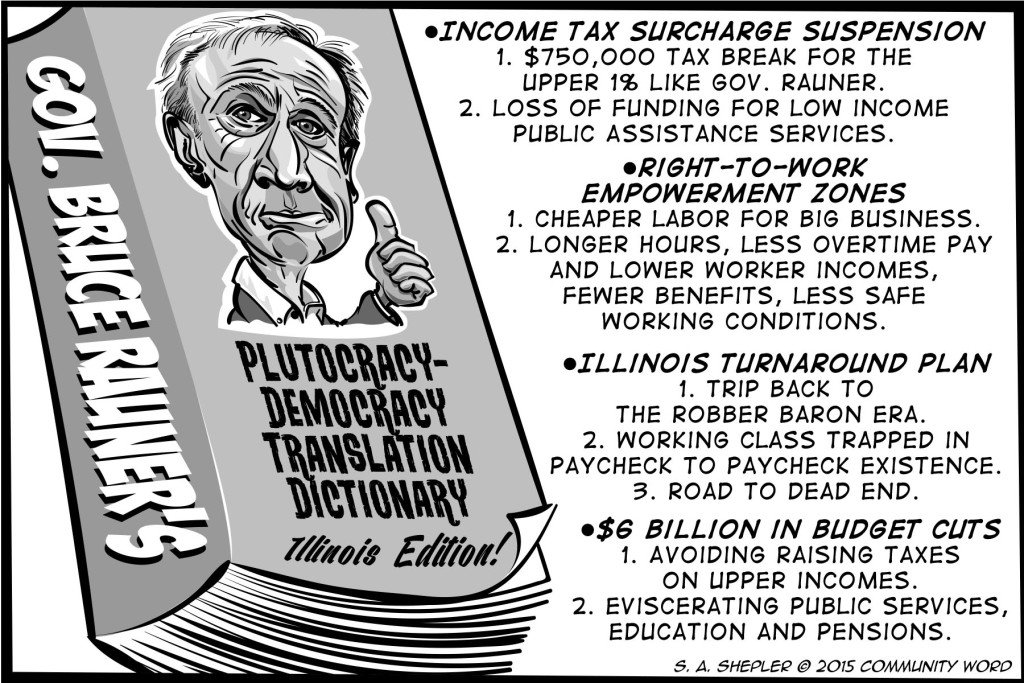

Words that obfuscate:

Cut the Illinois income tax surcharge: This really means a tax savings bonanza for high-income earners and a miniscule savings for middle- and low-income earners.

Right to work: This really means more low-paid, nonunion jobs for workers and greater profits for developers and corporations.

Efficient government: This really means lower taxes for corporations and the wealthy and dismantled services for low- and middle-income earners.

Linguist George Lakoff states “when you control the language, you control the message . . . . “ He writes that terms like “tax relief,” “partial birth abortion” and “death tax” were invented by the right to control the debate. When we use the language invented by conservative ideologues, we shoot ourselves in the foot.

Most of us feel we pay high taxes. So when Gov. Bruce Rauner suspended the state’s income tax surcharge, many people thought that might be a good move. In reality, the tax cut saves millionaires hundreds of thousands of dollars and wrecks devastating damage to low-income people needing assistance. People who view government as an inefficient, bloated bureaucracy favor cuts. People who view government as a tool for social responsibility view these cuts as a bad move.

For Rauner, elimination of the surcharge reduces his personal tax bill by a reported $750,000 a year. To compensate for the lost tax revenues, the state is cutting its funding for education, health care, child-care, immigration services and mental health services.

The Rauner Illinois Turnaround Plan calls for “Right to Work Empowerment Zones” that erode the right to work for good wages with benefits. The plan empowers developers and corporations to impose conditions on workers by undermining unions.

Rauner wants to deal with the state’s unfunded pension liability by scraping the system and shifting to individual 401(k) plans. Rather than fixing the system, he wants to eliminate this foundational government function and shift the responsibility to individual workers, forcing them to rely on financial advisors and Wall Street to ensure a secure retirement.

Rauner and his Turnaround Plan characterize government as evil, immoral and inefficient and see the free market, private sector as beneficial, moral and efficient. Rauner told the Chicago Tribune editorial board: “We have a moral duty to have an efficient government. The tax money belongs to the taxpayers. It doesn’t belong to the bureaucracy, and government is not a welfare system.”

Restating this position with Lakoff’s principles in mind: The goal of government is to provide a moral social contract that includes protections like pensions, public education, health care and laws that foster strong unions. Government should implement laws to protect against discrimination and protect the basic human rights of all people. Efficiency is a tool for measuring machines, not social obligations. Rauner wants to measure the efficiency of basic human rights. He wants to assess the cost-benefit analysis of morality. He wants to monetize the moral obligation of government’s egalitarian obligations.

Save $152.8 billion a year in taxpayer

money by increasing minimum wage

The recent nationwide protest by tens of thousands of low-income workers and activists in over 200 American cities including Peoria highlighted wage inequality and the fight for $15.

Their fight should be everyone’s fight.

For years, leading economists have warned that extreme wage inequality in this country is a leading threat to the economy. Now a report from the Center for Labor Research and Education, University of California-Berkeley, has issued a report “The High Public Cost of Low Wages.”

According to the study, low wages are costing U.S. taxpayers $152.8 billion a year in taxpayer support for working families. These are not the unemployed but families with full-time jobs that pay so little the family qualifies for food stamps, Medicaid, and other assistance. Nearly 75 percent of people helped by programs geared to the poor are members of families headed by a full-time worker.

Failing to mandate a raise in the minimum wage means, in effect, taxpayers continue to provide an additional subsidy for corporations like McDonalds and WalMart. Failing to mandate a raise in the minimum wage means it’s OK that people work full time in the wealthiest country in the world and still live in poverty.

A recently released report, “Picking up the NRA’s(National Restaurant Association’s) Tab: The Public Cost of Low Wages in the Restaurant Industry,” from Restaurant Opportunities Center, found nearly half of families of full-service restaurant workers are enrolled in public assistance programs.

Here’s a breakdown of the annual cost of public assistance for low-wage workers at these corporations whose CEO’s earn millions:

Cracker Barrel, $166,870,371; CEO compensation $5.6 million.

Brinker International, (Chili’s Grill & Bar), $237,432,503; CEO compensation $3.6 million.

Darden, (Olive Garden, LongHorn SteakHouse), $339,772,942; CEO compensation $7 million. (The taxpayer cost for government social programs for employees of a single Olive Garden, according to the report, is $196,970 annually.)

Dine Equity, (IHOP, Applebees), $449,569,135; CEO compensation $6.6 million.

Bloomin’ Brands, (Outback Steakhouse), owned by Bain Capital from 2007 to March 2015, $233,711,874; CEO salary $6.2 million.

Raising the minimum wage is more honest than these stealth subsidies for corporations. Raising the minimum will benefit the entire economy because consumers drive the economy, and raising the minimum creates more consumers.

Clare Howard