WILLIAM RAU

What a difference a decade makes. Climate-destabilizing, coal-fired electricity expanded 2000-2010, and over 100 new coal plants were on the drawing boards. Coal-fired power achieved its Illinois peak in 2008 at 96.7 MMWh (million megawatt hours) which bested nuclear power’s 95.2 MMWh. Coal and nukes then produced over 95% of Illinois’ total electricity consumption, their share for several decades.

The second decade unleashed coal’s death spiral: 80.8, 59.3 and 31.2 MMWh in 2012, 2016, and 2020 respectively –– a whopping decline of -67%, 2008 to 2020. Other things being equal (they aren’t), coal electricity in Illinois is gone by 2026.

What happened? Just about everything.

First, Illinois deregulated energy production in 1998. Coal then had to compete for market share. Second, economic growth decoupled from electricity consumption and, after 2013, energy use began declining even as Illinois’ economy grew. Third, speculative investment unleashed frenzied drilling for shale (fracked) gas. Severe overproduction cratered gas prices for nine years (2011-2013, 2015-2020) and gave gas-fired electricity a cost advantage over coal. Fourth, despite Exelon’s efforts to stifle Illinois wind power, it grew from 18,000 megawatt hours in 2003 to 16.2 MMWh in 2020. The four together are ringing coal’s death knell.

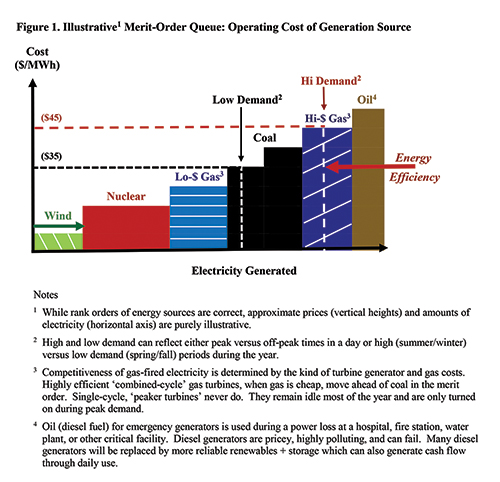

Figure 1 shows how a deregulated electricity market works. When a utility wants to buy lots of electricity, the market manager stacks bids from the lowest- to the highest-cost bid needed to fill the order. That stack is the “merit-order queue.” Everyone in the queue receives the price of the last, highest-cost bid (the market clearing price). Lowest-cost producers receive good returns, higher-cost entrants scrape by, and those failing the merit-order cut go out of business. As Figure 1 indicates, coal is being squeezed on the left by the expansion of wind power and on the right by energy efficiency’s reduction of total demand. Coal-sourced electricity declined -4.9 MMWh per year, 2008 to 2020 because energy efficiency, gas, wind, and nukes respectively wrested from coal +1.8, +1.6, +1.1 and +0.35 MMWh per year. This zero-sum contest dictated everyone else’s gain as coal’s loss.

This trend may be interrupted because financing for fracking has dried up. The fracking industry has never turned a profit but requires large, ongoing infusions of capital. As Wall Street sat on the sidelines, drilling and production dropped and gas prices are now headed through the roof. High-cost gas will give some coal-fired plants a temporary reprieve since coal can currently underbid now costly gas-fired electricity. However, even if gas never again drops below coal prices, CEJA will expand wind and solar four fold by 2030. The combined impact of renewables and energy efficiency should spell the end of electricity by coal before 2030.

It’s ironic. Greens tried to kill coal with regulations and mostly failed. Regulations had and will have an impact, but in Illinois coal was largely undone by the “tender mercies” of a competitive market. Ideally, Americans would turn to another market reform: a dividend-based carbon tax to kill all fossils in all 50 states (Wherle, et al. 2020; Rau, Nov 2020 thru Jan 2021 columns).

Recent Comments